You Don’t Have to Win the Startup Lottery to Become a Millionaire

How diversifying your earnings can pave the way for long-term financial success.

I know a few people who have built and sold their own company. They worked on it for years and finally cashed out. Now they’re millionaires and doing pretty well for themselves.

But statistically, only 10% of startups succeed. The rest fail to gain traction.

Here’s another statistic for you: the average millionaire has seven income streams:

- Earned income from a paycheck

- Dividend income from stocks owned

- Rental income from real estate

- Royalty income from selling rights to use something they’ve written or invented

- Capital gains from selling appreciated assets

- Profits from businesses they own

- Interest from savings, CDs, bonds, or other lending activities

Well, then statistically speaking, owning a business is only one income stream.

Perhaps being a “business owner” isn’t the absolute best way to get to seven figures. It might have worked out for a few people, but it also didn’t work out for many more.

A better approach to becoming a millionaire

The key is to create multiple income streams while you work your 9-to-5.

You might be thinking, how can I own multiple businesses when I can’t even start one?

Well, the answer is simple: throw things on the wall and see what sticks.

So many people don’t get started on their business because the idea of trying to make a million dollars scares them. They overthink their “business plan” and worry about how their idea will scale to a billion users when they don’t even have their first one yet.

Get over the idea of putting all your eggs into one basket. You don’t have to make a million dollars on your first try.

Before you make a million dollars, you have to make a thousand. And before you make a thousand, just make one dollar.

Rethinking a million dollars

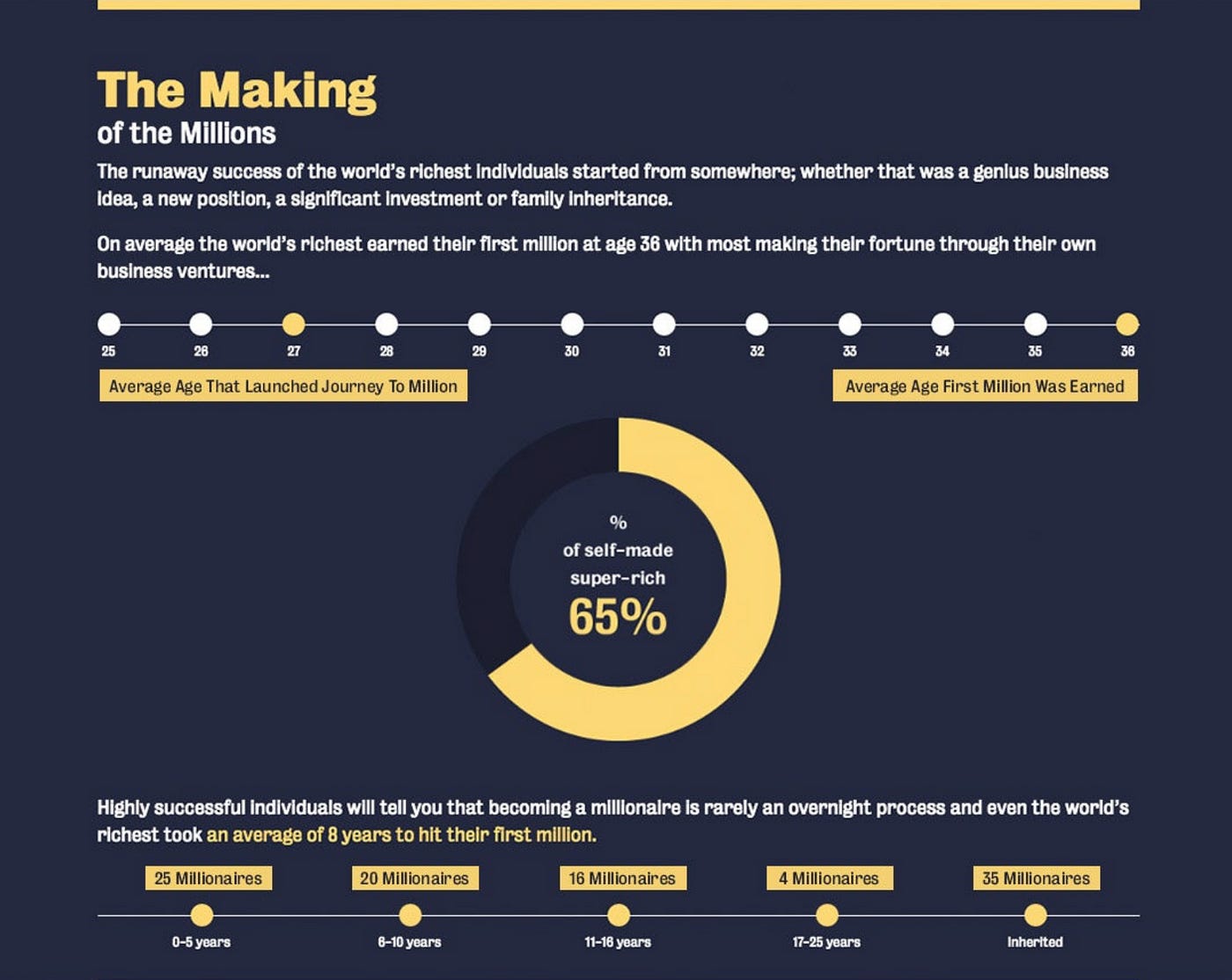

If we look at some of the world’s top billionaires, on average, they took about eight years to reach their first million dollars.

But let’s say time is not an issue, since we aren’t trying to build and sell a startup in our 30s.

Rather, we’re focused on slowly building income streams as side hustles, so that over the course of your career, you would have made a million dollars in addition to your 9-to-5 salary.

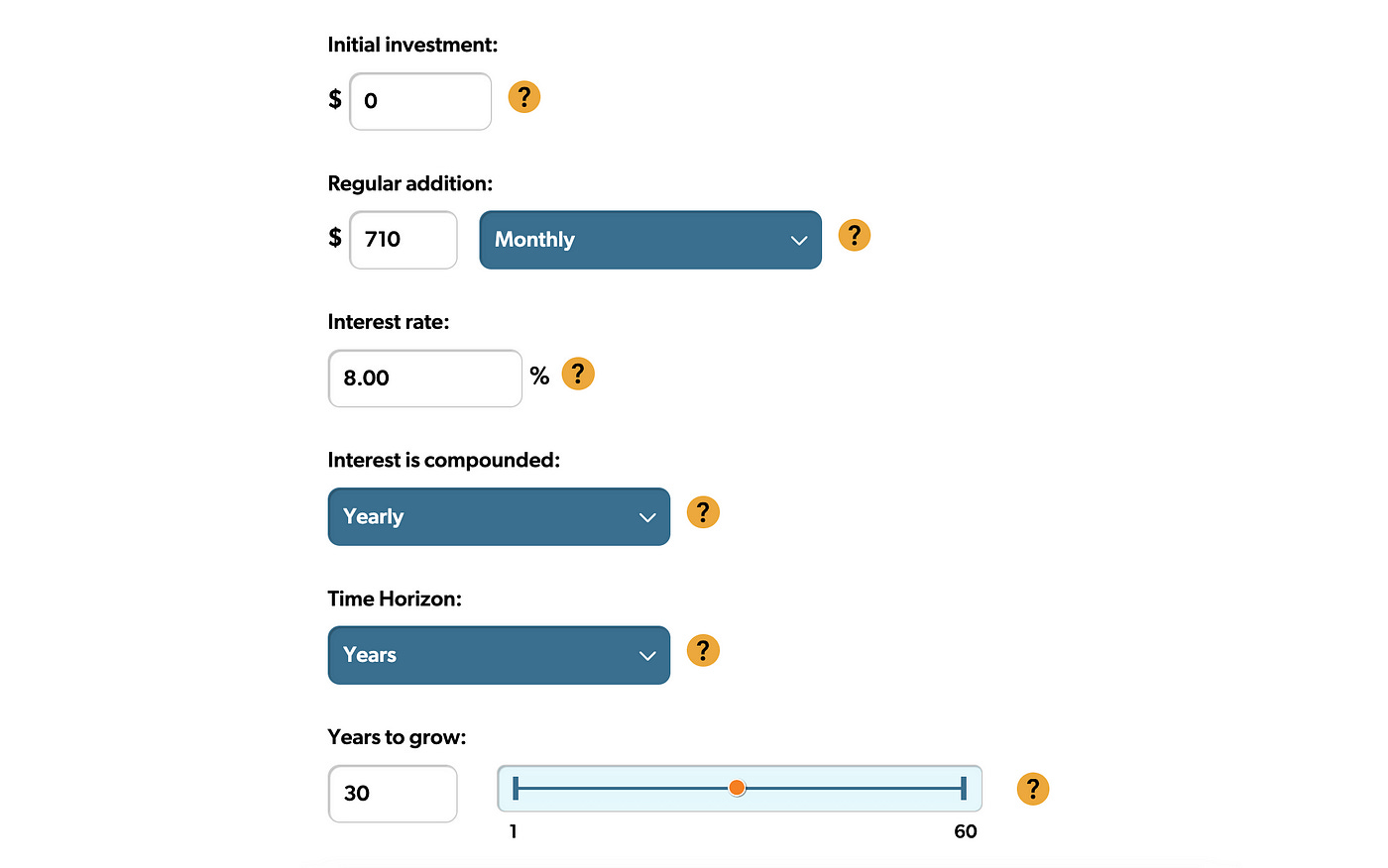

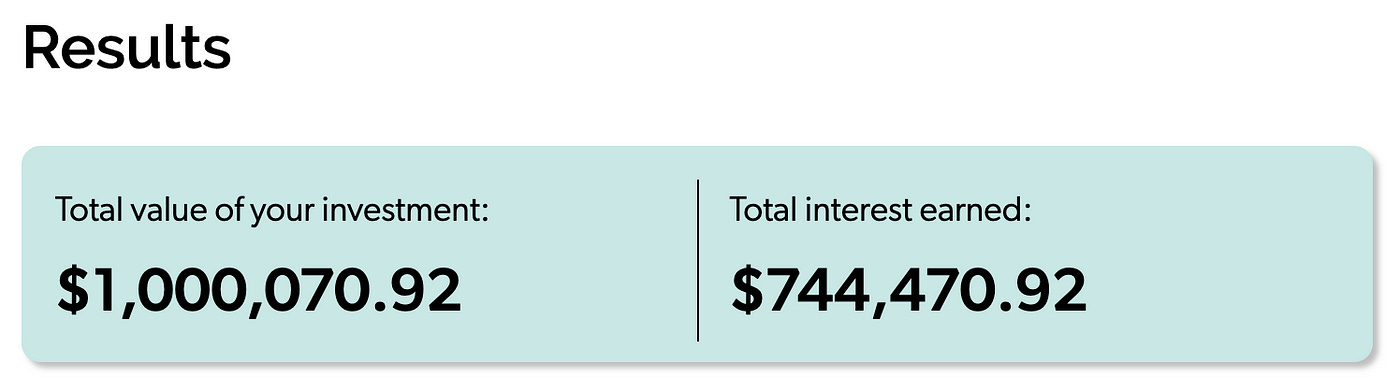

Assume you work for 30 years at your job, and your side hustle income streams bring in an average of $710 a month after tax over 30 years.

If you invested all your earnings each year in an S&P 500 ETF, then you’ll roughly have made a million dollars with an average expected return rate of 8%.

I’m not saying this is an easy feat by any means. But breaking down a million dollars over 30 years makes it seem much more achievable.

And if you don’t end up making a million dollars, you’ll probably still be better off than having made nothing at all.

Start small and don’t look back

To get started, think about your interests or hobbies.

What can you do or talk about for hours and hours without getting bored?

You could start selling cookies out of your own kitchen.

Or do engagement photoshoots for your friends.

Or start a blog writing about how to make a million dollars.

Identify one thing that you think you can do to slowly build up an income stream. Once you’ve chosen your thing, focus on making your first dollar. But don’t expect results right away.

Results = Time x Dedication x Consistency

To get results, you have to:

- Invest your time over the long term.

- Be dedicated to achieving your vision.

- Be consistent and show up every day.

Then, after you’ve consistently dedicated your time to building your business, hopefully, you’ll start to see some results.

You might end up making $500 or $5,000, but the point is either you find something that sticks, or you move on to the next idea.

Learn about yourself

Once you’ve built one income stream, it’s much easier to start building your second, and your third, and so on.

You’ll start to learn:

- What you’re passionate about.

- What makes you excited to get out of bed in the morning.

- What’s working and what isn’t.

- What other business ideas you might want to explore.

Now you’re in the game, with multiple streams of income, some failures, and hopefully, a few successes. You’ve just unlocked your way to earning an extra million dollars by the time you retire.

Do what works for you

By testing and iterating on many ideas over time, you have better chances of succeeding at something, rather than sitting at home and wondering if your idea will make it big. The lessons you learn from your failures will teach you how to succeed.

You don't have to start a tech company, get a billion users, and IPO on the stock market to make a million dollars.

Do it the slow and steady way. Do what works for you.