Why I'm Choosing to Rent My Way to Financial Freedom

Exploring the liberating decision to prioritize flexibility, savings, and personal growth over homeownership.

The debate of rent vs. own has been a huge topic ever since inflation has snowballed and the cost of living has gone through the roof (pun intended).

My parents always ask me when I’m going to buy a house, but they still think that houses cost $1,000 and that we’re not in the biggest housing bubble in Canadian history.

So the other option is to rent. But gone are the days of $500/month rent, at least where I live.

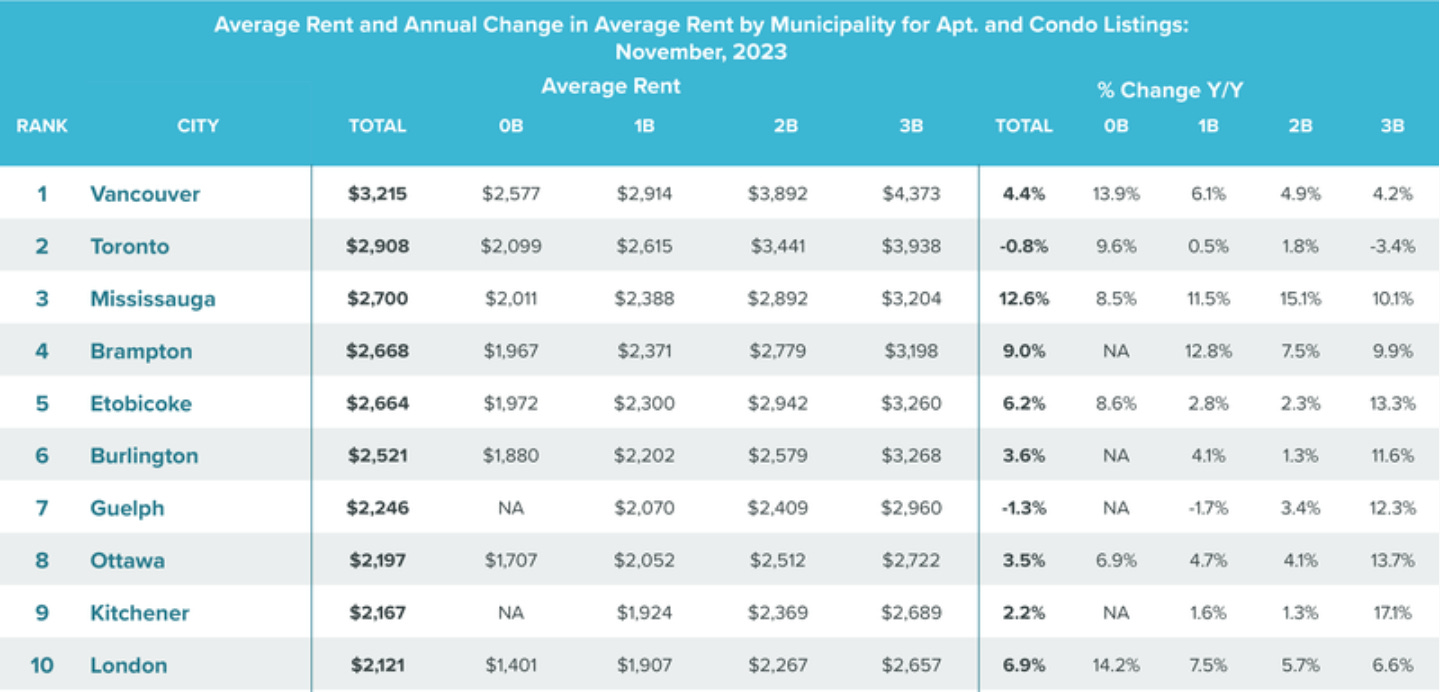

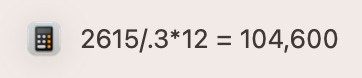

As of November 2023, renting a one-bedroom apartment in Toronto would set you back $2,615/month, which is insane to see.

Following the common guideline of spending 30% of your gross income towards housing, a person would have to be making $105,000/year just to rent out that one-bedroom unit.

I’ll admit, I am privileged.

I believe that luck can affect any outcome to a certain degree.

Some people are just luckier than others.

💰 You’d be lucky if you ended up graduating with a six-figure job lined up.

Not to say you didn’t work hard or prepare well to get that job.

But entry-level competition is immense in every field, so any job is better than no job, right?

Okay, so you’ve secured a decent income in the big city.

🏠 Now, you’d be lucky if a landlord chooses your name out of the hundreds of other people looking to rent the same unit.

✍🏼 And after you’ve signed on the dotted line, you’d be even luckier if they aren’t a slumlord who preys on the vulnerable.

📈 You must have infinite luck if you somehow manage to lock down a unit in a rent-controlled building.

💸 Otherwise, good luck paying rent next year when your landlord decides to hike it by 20% while your salary remains unchanged.

🛠️ And finally, it’s not uncommon for landlords to kick out their tenants so that their “family member can move in” or they can “do renovations to the unit”, also known as a renoviction.

You’d be just plain lucky if your landlord is not an asshole.

This is not America.

But despite all of these things working against me, I will still choose to rent in this city, even though I have enough saved for a down payment on a $600,000 shoebox in the sky.

When I compare the alternative to renting, home ownership just doesn’t sound any better.

Unlike our neighbors down south, Canadians don’t have the benefit of locking in a 30-year fixed-rate mortgage.

So when your mortgage term is up for renewal, you have no control over what the interest rate might be three or five years from now. If rates go up, so does your mortgage payment.

People who bought real estate ten to fifteen years ago enjoyed historically low interest rates when their mortgage was the biggest, allowing them to effectively borrow money for free after accounting for inflation.

And for the average homeowner, Canadians aren’t allowed to claim mortgage interest as a tax deduction like our American friends can.

So what’s the incentive for me to take out hundreds of thousands of dollars in debt when interest rates are higher than they have been in the last decade and it’s not tax deductible?

Real estate is a great investment… or is it?

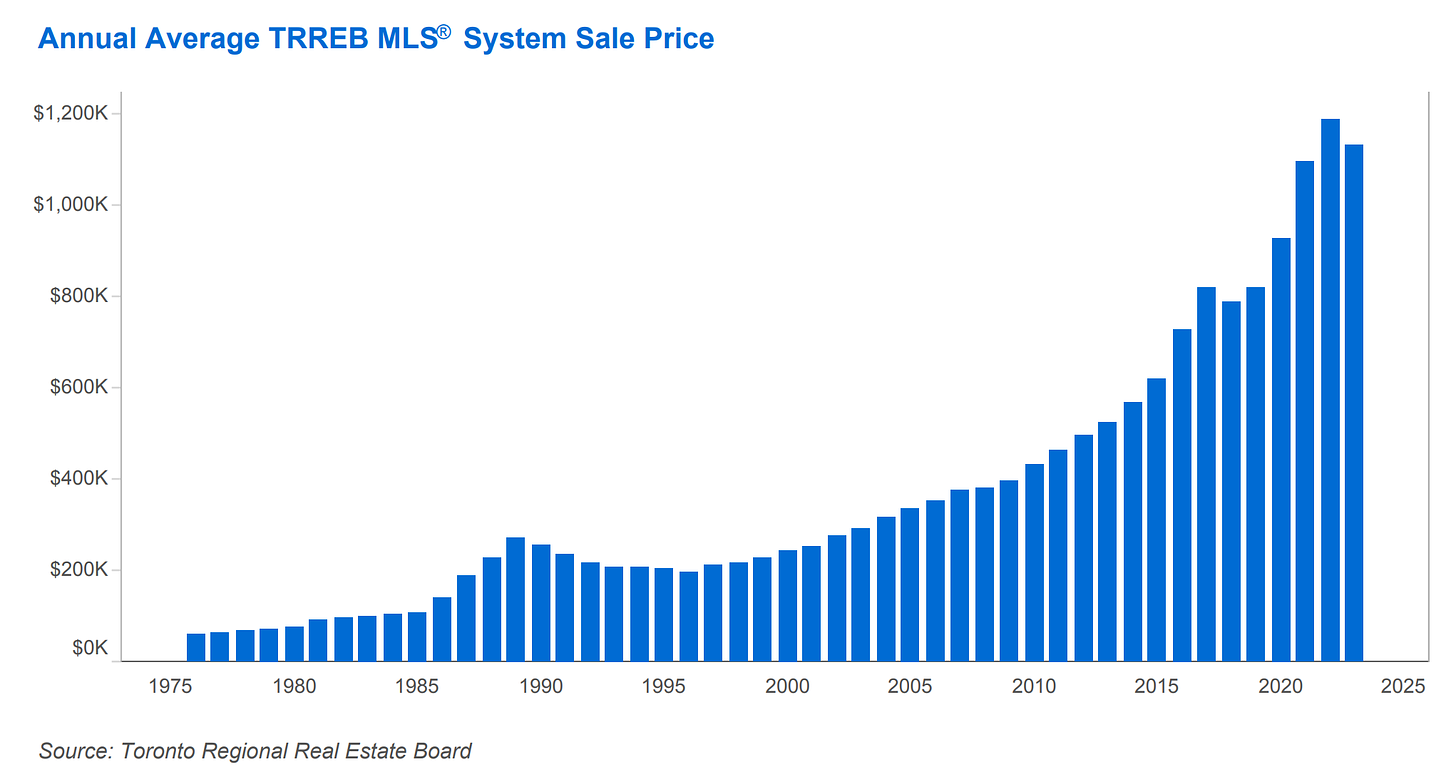

From the bottom of the 2008 housing market crash, Toronto real estate prices have risen from $380,000 to almost $1.2 million.

That averages out to around an 8% return over the last 15 years, a bit lower than the historical average returns of the S&P 500.

But why not take on 5:1 leverage and get out-sized returns in the housing market? Then your 8% return becomes a whopping 40% in the first year!

But here’s where things don’t make sense to me.

Why are we constantly told to diversify our stock portfolio by buying index funds?

Well, because generally, people would rather sacrifice out-sized returns for lower, but more stable ones. By spreading out all of your eggs, you are better protected against volatility and uncertainty.

Buying an index fund that tracks the S&P 500 allows you to invest in 500 different companies. So if a bunch of them go down in price, you’re hedged by owning the rest of the basket.

So then why in the world would I go all-in on one house in one city?

Real estate is just another asset in your total asset allocation.

Say I invested my money over ten years and finally my portfolio has enough for a down payment on a house.

Why would I sell ownership of 500 relatively stable stocks and risk my whole life savings in one asset?

At least buying an individual stock is liquid and doesn’t come with the maintenance and closing costs of buying real estate.

Sure, you could argue that real estate is more stable than an individual stock, or real estate always goes up, but the other end of the equation is income, and that’s a different story.

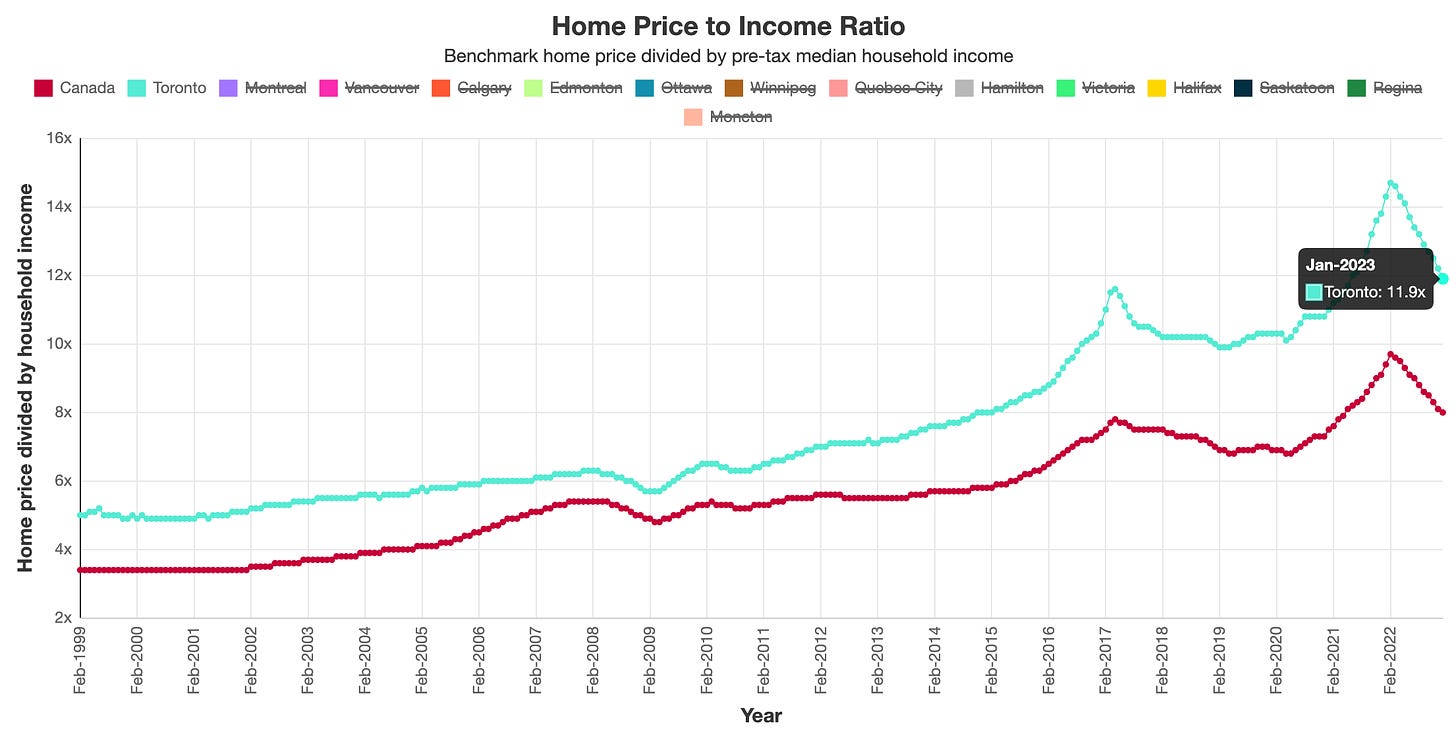

How am I expected to comfortably afford a house at a price-to-income ratio of 12, double what it was back in 2008?

I’d rather not feel “house poor” and funnel my entire paycheck into having a roof over my head.

And viewing a house as a “forced savings account” isn’t really that appealing when I don’t have any problem saving for my own retirement,

At least I have control over where my money is saved and the ability to instantly pull out money when I need it.

Not to mention all of the hidden costs that come with owning real estate:

❌ Maintenance costs: Around 1% of the house value each year

❌ HOA or condo fees: Increases on average 5 to 10% each year

❌ Property taxes: Rent payment to the government

❌ Closing costs: Ranges from 2% to 5% of the sale price

❌ Random costs: Filling up space with crap you don’t need

❌ Time wasted: Mowing the lawn, shoveling snow, cleaning rooms you barely use

All of these costs start to add up and will cut into your returns.

Buy a house, they said.

The biggest cost that doesn’t seem worth it to me is time wasted, which is the hardest to quantify.

How much do I value not having to cut and water grass in the summer, just to maintain the look of my house?

That’s a weekly activity that I’m not about to sign up for.

And in the winter, it’s the same thing with shoveling snow, except it’s more of a necessity if you want to get out of your driveway.

As a renter, I don’t have to deal with those headaches. I pay my rent on the 1st of the month and I go about living my life.

If my fridge starts leaking or the heater stops working (both of which have happened in my unit), those are the landlord’s problems.

It’s not coming out of my pocket.

Flexibility is key.

I’m not sold on living in Toronto forever, as the cost of living continues to rise and people are feeling the squeeze on their wallets.

If I own a house, I can’t just get up and move across the country or to another country for that matter.

And for people who can’t work remotely, this limits your opportunities to the ones as far as you’re willing to commute.

In the same way that a 9-to-5 job ties you to your income, purchasing a house ties you down to one location.

Not that one is better than the other.

It’s just a lifestyle choice.

For me, I value the flexibility of being able to move when I want.

Maybe I’m unconventional, but as one half of a DINK (dual income, no kids) couple, I’d rather have the option to enjoy life while someone else foots the bill for repairs.

Not to say that renting doesn’t come with any downsides.

Do I enjoy hearing my neighbor’s baby cry his head off from time to time? No.

I could get a message from my landlord tomorrow saying that his cousin’s niece wants to move into the unit and I’ll be forced to move out.

But I’ll face that issue if and when it comes around.

For now, I’ll keep renting, enjoying the perks of condo life including:

🛎️ Concierge service that protects my Amazon packages from being stolen off the front porch

🚙 Heated garage where I don’t have to shovel snow off of my car in the morning

💪🏼 A gym that’s one elevator ride away

🍣 A prime location that doesn’t require driving to get amazing sushi

I’ll keep investing the way I want

And that’s investing in assets, whether publicly traded or owned by me.

Stocks provide a convenient way to grow my money while remaining relatively liquid.

Even Warren Buffett said this about his decision to purchase a house:

“All things considered, the third best investment I ever made was the purchase of my home, though I would have made far more money had I instead rented and used the purchase money to buy stocks.”

The greatest investor of all time admitted that stocks would have been a better investment than buying a house, even when he only paid $31,500 for it in 1958, and it’s now worth around $1.4 million.

The risk with stocks is that I have no control over whether they go up or down.

All I can do is research and invest in profitable companies that are:

- Well-diversified within their operations,

- Have a good track record of growth and trusted management, and

- Within my circle of competence.

And of course, limit my risk by knowing when to cut losses

Starting a business gives you control over the growth of an asset, which neither stocks nor real estate can give you.

To me, having control is the biggest part of achieving financial freedom, whether it’s over investments or income.

With starting a business, you’re in charge of both.

The risk is a lot higher, but so is the reward.

Without being tied down by salary or location, you have the freedom and flexibility to do what you want and define your future.

I’m not 100% there yet, as I’m still figuring things out along this journey, but I just wanted to lay out my thoughts on the topic.

I’m also curious to know your thoughts on renting vs. buying a house.

Of course, it’s highly dependent on where you live.

But ultimately to me, it’s much more of a lifestyle choice than it is an investment decision.