The Biggest Thing Holding You Back From Financial Independence

Discover how mastering your emotions is the key to overcoming barriers and achieving true financial freedom.

Warren Buffett, the Oracle of Omaha himself, once said:

“If you cannot control your emotions, you cannot control your money.”

After a few years on my journey towards financial independence, I’ve found this to be true.

Humans are emotional by nature.

- We act irrationally.

- We spend impulsively.

- We compare ourselves to others.

Emotions dictate our decisions and can be a tricky thing to handle.

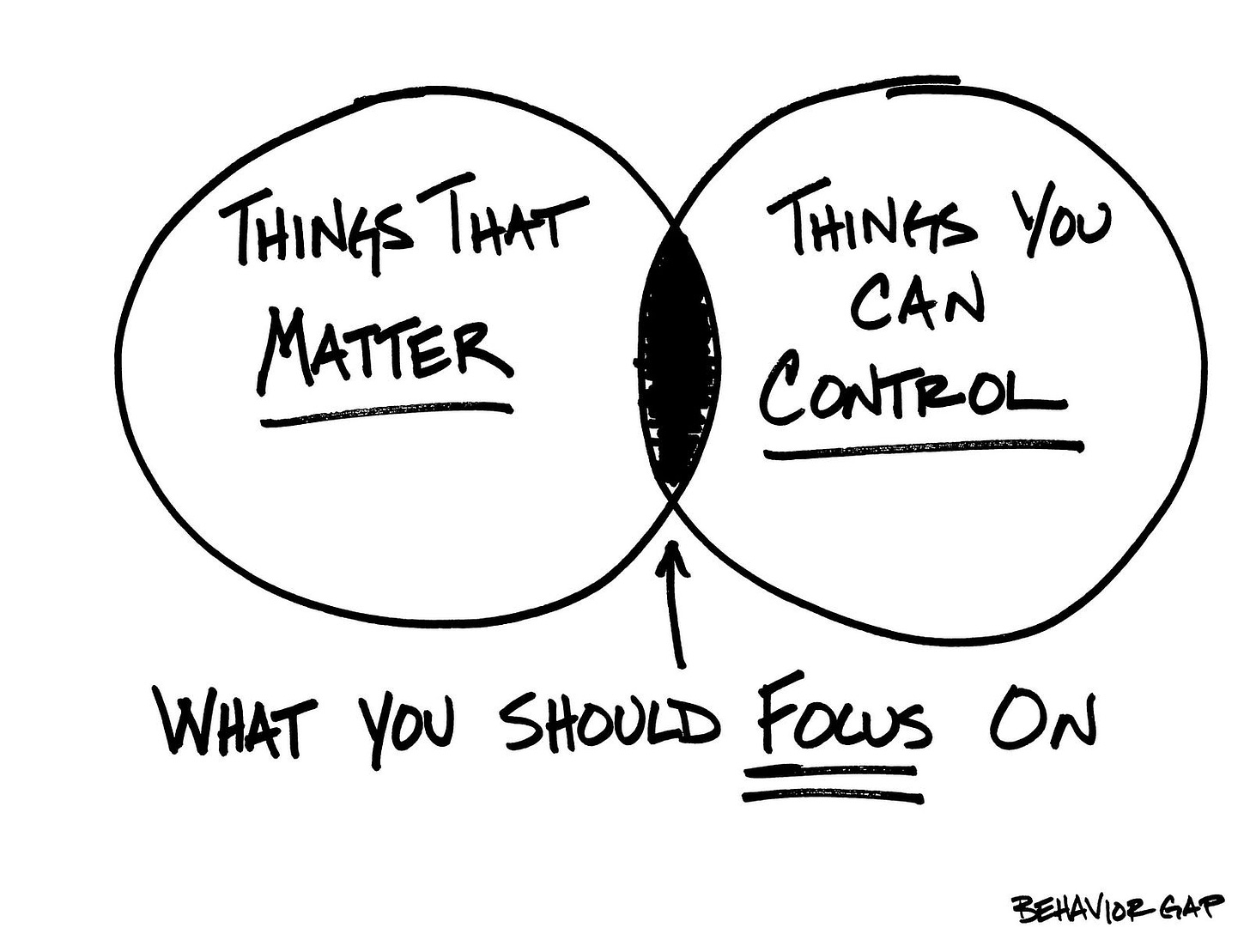

We can worry all we want about stocks crashing, interest rates hiking, or getting laid off from our jobs.

But none of this is within our control.

Focus on things you can control and things that matter.

If you can control your emotions, you can control your money.

Essentially, emotional control is a form of money management that can make a big difference on your path toward financial independence.

Here are three ways that shifting your money mindset can change the way you respond to financial situations.

1. Irrational investing (FOMO)

Every day, the stock market goes up and down, fluctuating the prices of individual companies.

Once in a while, a stock might make a big move and start to pique my interest.

Does that mean the stock is worth buying after it’s jumped 30%? After all, others are buying it so it must be a good opportunity.

Or should I buy a stock after it’s tanked 50%? It’s got to go back up someday, right?

I might miss the train to becoming a millionaire.

Wrong.

It was exactly this mentality that lost me over $100,000 during the stock market hype train in 2021.

I started thinking about all the things I could buy with my soon-to-be million-dollar portfolio and then boom… there goes my last two years of savings.

Fear of missing out (FOMO) blinds you from making rational investment decisions.

Before you invest in something because you’re afraid of missing out, take a step back and chill for a second.

If investing were that easy, then everyone would be a millionaire.

You can’t control where asset prices go in the future, but you can control what you invest in. You can also control how you react to market fluctuations.

In another quote from Warren Buffett, he said:

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Chasing prices without fully considering the fundamentals of a business is a risky game.

So don’t be too quick to pull the trigger on an investment before you do your own research.

Don’t let FOMO get the best of you.

2. Impulse spending (stress)

Luckily, I don’t have a spending problem.

Instead of stress shopping, I just stress eat. It’s much better for my wallet.

But for real, let’s talk about emotional spending.

It can make us feel better in the short term, and that’s okay. Sometimes you just have to drop some cash to let off steam.

However, realize that your emotional response to stress can affect your financial stability if it gets out of control.

What starts off as a way to make yourself feel better in the moment could lead to overspending and potentially racking up the worst form of debt: credit card debt.

The lasting effects of a shopping spree could impact your budget for the rest of the year, or even spiral into a bad habit and ruin your financial stability.

You’ll spend a long time paying off the interest, putting your savings and investment goals on hold.

For me personally, the consequences are too risky.

Instead, try other ways of dealing with stress that don’t involve spending money. You could:

- Hit the gym

- Go for a nature walk

- Vent to a friend

- Play with a dog

- Take a long shower

It’s easy to feel overwhelmed when your financial plans aren’t going as planned. But don’t be afraid to ask for help when you need it.

There’s no shame in reaching out when times are tough. Getting help is a step toward better money and stress management in the future.

Regardless of how you choose to manage your stress, it’s a choice that’s within your control.

3. Financial fraud (anxiety and fear)

Scammers are among the worst kinds of people.

They prey on the vulnerable, like your retired grandma who barely knows English and hasn’t used a smartphone before.

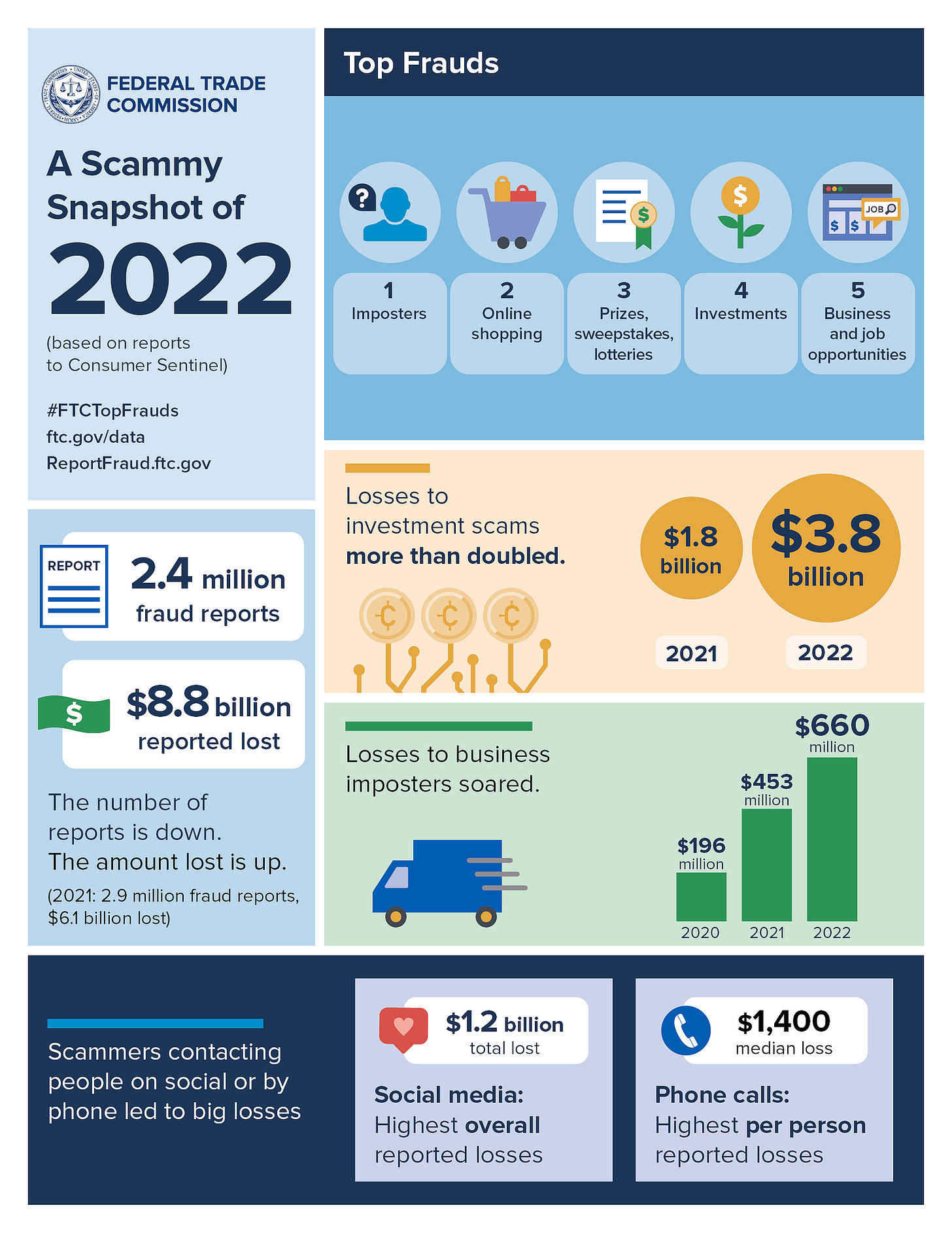

Last year, more than $8 billion was reported lost due to financial fraud and investment scams.

It’s only natural for people in tough situations to feel anxious when someone claiming to be the government tells them to fork over their life savings or risk getting deported.

Imagine everything you worked years for being taken away in a matter of seconds.

All because a scammer chose to scam you.

Often, the emotional toll of financial fraud can weigh heavier than the financial losses themselves. It’s devastating for victims to face these circumstances and be forced to try and financially recover.

The worst part is that people with low financial literacy often become victims, so their emotions take control. They can’t recognize the signs of a potential fraud or scam because they are simply concerned about surviving.

If you’re reading this article, then you’re already ahead of the pack.

Protect yourself and your loved ones by learning about common scams, such as tax official impersonators or too-good-to-be-true scenarios.

By learning the signs of a scam, you’ll be better prepared to recognize and report it before your emotions take over.

Scammers, leave grandma alone.

Money without emotional control is useless

Learning to control your emotions is tough. It’s not going to work every time.

But you can build up your mental discipline by following these rules to achieve financial independence. These can help prevent your finances from spiraling out of control.

Just don’t be so hard on yourself if your emotions take over once in a while.

I still fall victim to the comparison game sometimes.

I just remind myself to stay in my lane and focus on improving next time.

Learn to control your emotions, and you’ll have your money under control.